Introduction

Electricity is an unusual commodity, as its production and consumption occur simultaneously. Unless generated on-site, electricity is pooled within the transmission and distribution grid, where it “mixes” before being delivered to multiple customers. As a result, it’s impossible to claim that all the electricity you consume from a grid at a given moment came from a single source of generation with a specific emissions rate.[1]

At the same time, companies are eager to demonstrate that they have matched 100% of their electricity consumption with renewable energy and have reached zero scope 2 emissions. To address this desire, companies have used annual energy attribute certificates, such as Renewable Energy Certificates (RECs),[2] to claim ownership of generator-specific renewable energy and scope 2 emission factor attributes.

The majority of corporate REC buyers purchase annual RECs in the spot market from existing projects.[3] Current corporate greenhouse gas (GHG) reporting standards permit renewable energy claims based on certificates from energy generated at any time during the same calendar year, provided it falls within broad electricity market boundaries.

While some companies have reached beyond current requirements to use long-term forward contracts with new renewable energy projects, concerns have grown that scope 2 GHG accounting standards are too loose, and that the geographically broad spot markets used by most buyers to procure annual RECs are neither driving more clean energy development nor enabling very accurate electricity-generation-to-consumption matching claims.

Major Corporate GHG Accounting Standards are Being Rewritten

To address concerns about scientific integrity and impact, GHG accounting and target-setting standards are currently being rewritten to update how companies should report on indirect emissions associated with their electricity consumption (e.g., scope 2), as well as claim impacts from market-based actions using RECs and long-term contracts.

The guiding principles for updates to these standards are to improve the actual (and perceived) accuracy of reported indirect emissions of corporate electricity consumption and recognize genuine avoided emission impacts of ambitious market-based action—such as through RECs and contracts—that affect renewable energy development while ensuring that it is practical for most companies to abide by the new reporting standards.

During the update process, an open question has been how to define good practices for corporate reporting of these market-based actions within wholesale electricity markets. Fundamentally, this question involves two distinct types of market-based claims:

- The first asks about the degree to which a company’s electricity consumption is “matched” with market-based instruments, such as RECs, under the assumption that the financial transaction is a legitimate proxy for matching with a specific renewable energy generator.

- The second asks about the avoided emissions impact in the electric power sector associated with the company’s market-based action.

Historically, corporate GHG reporting has emphasized the “matching” framing. Yet, the fundamental type of claim desired by companies and the purpose of these certificate markets is to cause the avoidance of power sector emissions. Therefore, a new corporate reporting statement dedicated to quantifying the avoided emissions resulting from corporate actions is a better “match” of GHG accounting method with the nature of the desired claims.

Within the generation-to-consumption matching framing, one proposal that has gained momentum as a possible requirement for updated corporate scope 2 reporting and the entire voluntary green power market is hourly matching. This would require a transition from the current use of annual RECs and broad market boundaries to hourly RECs within narrower market boundaries based on the physical deliverability of electricity.

While this higher temporal and market boundary matching proposal appears promising, it could have unintended consequences for corporate GHG target setting, project financing, and renewable energy market mechanisms, potentially slowing the clean energy transition.

Current Market Mechanisms and the Usage of PPAs

The more recent star of voluntary corporate action has been the Power Purchase Agreement (PPA) in its various forms (see Box 1). When used by corporate electricity consumers, these long-term forward contracts around annual RECs and energy price risk often help de-risk renewable energy project development and, in many cases, probably enable additional investment in new clean energy projects.

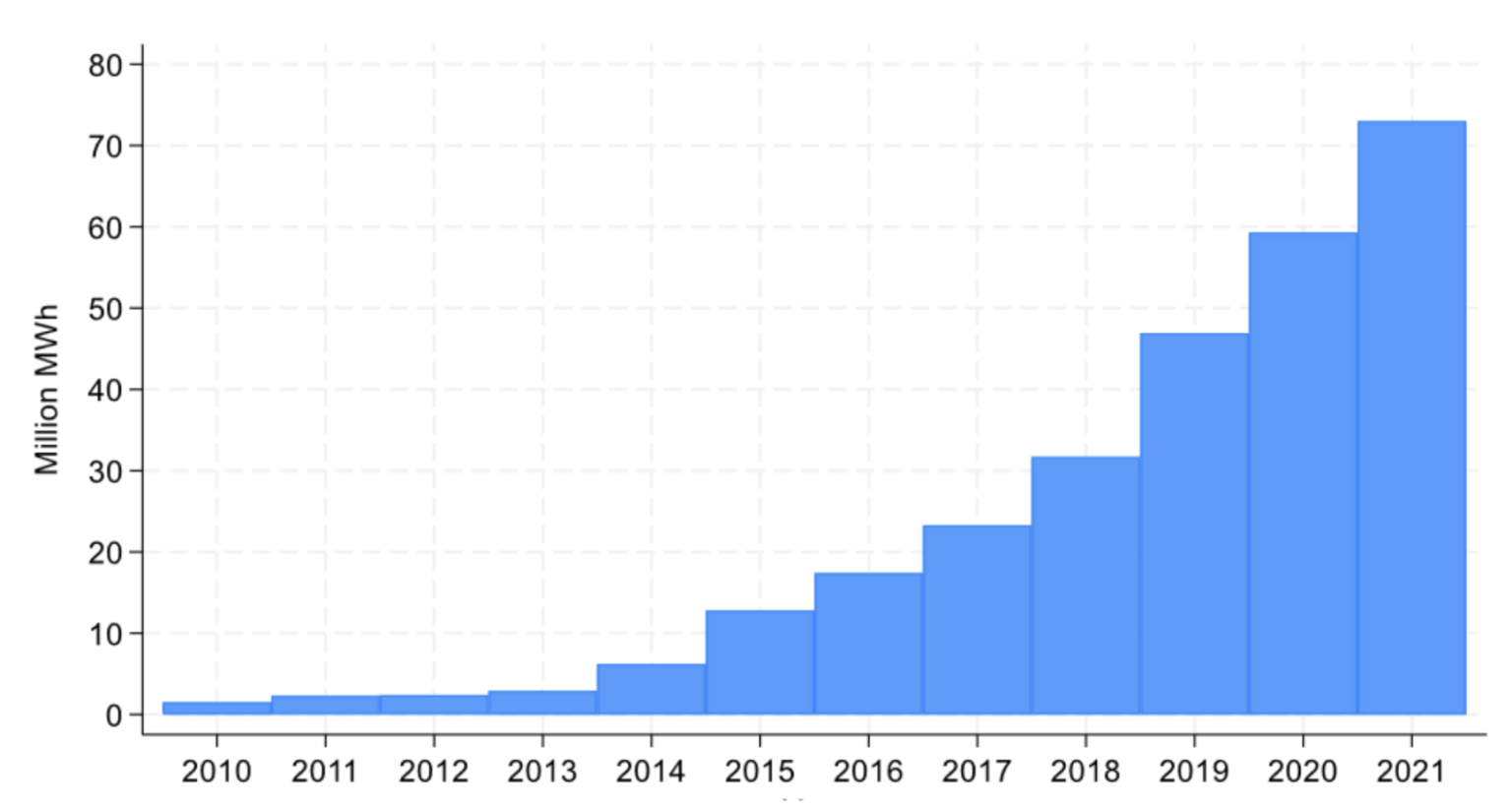

Over the past 15 years, companies have signed PPAs associated with the development of 200 gigawatts[4] of added renewable energy generation capacity—enough to power over 90 million households globally (Figure 1).

Figure 1. US voluntary green power market PPA activity over time. Data from the NREL survey (O’Shaughnessy and Heeter, 2022).

Figure 1. US voluntary green power market PPA activity over time. Data from the NREL survey (O’Shaughnessy and Heeter, 2022).

In 2023, the volume of RECs purchased through PPAs eclipsed annual RECs purchased in spot markets.[5] However, these PPAs were signed by just a few large companies (less than 1% of corporate REC buyers).

While PPAs are recommended by current standards,[6] they are not required, as they are often inaccessible to most companies. Hourly matched RECs seek to be far more accessible than PPAs and more impactful than annual RECs.

| Box 1. What is a Power Purchase Agreement?There are different kinds of Power Purchase Agreements (PPAs). Physical PPAs have long been used by load-serving entities (LSEs) (e.g., utility companies that sell and distribute power to retail consumers) to contract with generators and thereby fulfill electricity load delivery obligations to electricity consumers. They’re also sometimes used by non-utility companies, often in coordination with their LSE. In either case, the buyer pays an electricity generator, according to a long-term pricing structure, for supplying a specified amount of power that’s injected at designated transmission grid nodes and times. In contrast, Virtual PPAs are multi-year contracts that allow generators to engage in financial hedging on wholesale electricity prices directly with end-use companies (e.g., non-utilities) without altering physical power deliveries for LSEs in wholesale or retail power markets. In both types of PPA, the buyer assumes the energy price risk associated with the project, making it a more attractive investment. In exchange, the buyer hopes to receive long-term electricity pricing benefits and a stream of RECs initially issued to the renewable energy generator. |

The Promise of Hourly RECs (AKA 24/7 Carbon-Free Energy)

A transition from the existing approach of matching a company’s electricity consumption with annual RECs for scope 2 market-based reporting to one that uses hourly RECs would impose two new constraints:

-

- Temporal – RECs must be matched from energy generated in the same hour as the energy consumed by the company, rather than any time within the same calendar year.

- Geographical – Electricity consumption can only be matched with RECs from energy generated at a location close enough to the point of consumption that, within that hour, could reasonably be part of the pool of electricity physically deliverable to the consuming company. In the USA, this might involve using the EPA’s eGRID subregions[7] instead of allowing RECs from anywhere in the USA or Canada. In Europe, it could be the established bidding zones.[8]

Proponents of hourly RECs argue that imposing stricter temporal and geographic constraints on RECs should result in two renewable energy market impacts:

- Increase REC Pricing – Constraining REC supply temporally and geographically should, in theory, drive up spot market prices for hourly RECs during certain hours of scarcity, thereby increasing the financing subsidy effect of the hourly REC spot market for new renewable energy projects compared to the annual REC spot market.

- Incentivizing Complementary Technologies – Higher REC prices in certain hours should spur investments in other carbon-free energy (CFE) and energy storage technologies that can deliver or shift CFE to hours underserved by solar and wind (e.g., hours with a shortage of hourly RECs).

While hourly matched RECs appear to have great potential (especially in certain contexts[9]) and have been successfully integrated into public scope 2 reporting by at least one company,[10] the so-called “24/7 CFE” approach also may introduce new risks for renewable energy project development and the speed of the global transition to RE.

Risks of Requiring Hourly Matching

Hourly matching presents a more granular approach to the market-based scope 2 approach to matching consumption with generation, but also introduces some risks, including:

- Making long-term contracts less attractive – The success of long-term forward contracts such as PPAs, has been largely due to how they transfer the long-term revenue risks faced by proposed renewable energy projects to companies seeking to make scope 2 claims, thereby better enabling projects to be successfully financed.[11] Companies are currently able to sign these contracts in part due to the flexibility of the existing market-based approach, which permits them to purchase all of the annual RECs from a project for the next 10-20 years before the project is even financed and built. Suppose companies can only use RECs that represent energy deemed deliverable and matched to their consumption in each hour. They may be faced with two difficult options: i) sign more smaller PPAs, possibly for more RECs than they need annually, in each region they operate in and for different technologies to ensure they have enough RECs in each hour and jurisdiction they need them to hourly match or, ii) move from PPAs to the spot market where they can be sure they only purchase the number of RECs that match the hours they need. The first option is not good for companies, as each PPA comes with its own transaction costs and complexity. The second option is not good for renewable energy project financing, as the spot market does little to de-risk projects and could, therefore, result in fewer projects being financed and built. Recent survey data on corporate attitudes suggests the second option is more likely.[12][13]

- Making long-term contracts even less accessible – Due to the legal and financial complexity of PPAs, they are typically only done in large volumes (part of what makes them inaccessible to most companies). Many companies with distributed operations utilize PPAs by aggregating power usage across regions or an entire country, thereby achieving sufficient volume to commit to a PPA. These companies may find that any requirement for RECs to represent power deliverable to each of their locations prevents them from aggregating their demand, making PPAs inaccessible and forcing them into an hourly REC spot market, where they must purchase from existing renewable energy projects rather than forward contracting in a manner that helps de-risk project financing.

- Increasing costs and adding complexity resulting in reduced participation – Moving to a reporting framework where companies need to account for energy usage in subregions on an hourly basis and then sign more PPAs or move to the spot market to procure RECs that match in time and space, adds complexity and costs to participating in the voluntary market. This may lead some companies to opt out entirely, especially for businesses that have a distributed load (e.g., a retailer with storefronts across the country). While not impossible, more time and more money spent on reporting, setting targets, and achieving those targets will test companies’ commitment to these voluntary actions.

- Diluting support for renewable energy – We’re already seeing pooled PPAs (e.g., signed by utilities and then resold to companies via green tariffs) dilute support for renewables by adding supply from existing nuclear or hydroelectric generation to achieve a higher percentage of 24/7 CFE.[14] Shifting from long-term forward contracts that support more new renewable energy projects to offerings that use RECs from existing nuclear or hydroelectric projects that do not require this support would be a step backward for GHG accounting and recognition of meaningful corporate actions.

- Struggling with bankability and price volatility – Even if hourly REC spot-market prices will likely spike during shortages in certain hours, historical trends suggest that demand in the voluntary market will drop sharply once prices exceed about US$3 per REC. Volatility and uncertainty may also prevent the establishment of bankable forward curves essential for financing new CFE projects. This could mean the hourly REC spot market falls well short of the impact of the existing virtual PPAs and does not actually result in much of an improvement over the existing spot market for annual RECs.

- Improving the perceived accuracy of inventory accounting but reducing impact – Research has shown that the use of allocational (e.g., inventory) GHG accounting methods to support decisions can lead to unintended increases in global GHG emissions.[15] Currently, some companies opt to support CFE projects that are not local but instead are on a dirtier grid so their PPA enables a renewable energy project that avoids more emissions.[16] Requiring tighter market boundaries could limit or eliminate this practice, which can be directed to projects that have more impact on decarbonization and emissions in marginalized communities.

- Optimizing for individual companies instead of the overall grid – By pushing companies to focus on matching their own hourly consumption, a shift to hourly matching and 24/7 targets risks steering clean energy investments toward locations and technologies that maximize company-specific claims—rather than where new generation and energy storage capacity would deliver the greatest electric power sector-wide emission reductions. This may divert capital away from the most impactful projects and distort procurement priorities. Worse, it may encourage suboptimal grid system-level operational decisions—such as timing battery discharge to match individual corporate hourly matching needs rather than displace the most intensive fossil generation—undermining decarbonization goals.[17]

- Disincentivizing ambitious targets and action – A move to hourly matching will mean a lot of companies that have set 100% renewable energy goals will be faced with a much harder path ahead of them to achieve those targets. Getting to 100% renewable energy with hourly matching is estimated to require companies to sign PPAs for as much as 400% of what they actually use annually.[18] Furthermore, the market as a whole is likely to have a surplus supply in many hours, making it difficult to sell extra RECs in the spot market, as there will be little demand for those hours with a surplus. If companies are stuck, only able to make 20-65% CFE claims,[19] they may choose to simply resign themselves to abandoning their goals entirely.

- Allowing gaming with fractional matching – For quite some time after a shift to required hourly matching, few companies will be able to match 100% of their consumption (e.g., load) with hourly RECs. Therefore, most companies will only report fractional matching and associated market-based scope 2 emission claims. However, fractional matching with corporate electricity consumption introduces ambiguity and the potential for misleading optics. For instance, a company claiming 50% hourly matching might be covering only the easiest, lowest-impact hours when hourly RECs are cheap and renewable energy is abundant on the grid. Meanwhile, another company matching just 10% could target only the most carbon-intensive hours when hourly RECs are expensive and clean energy is scarce, thereby causing far greater avoided emission impacts. The problem? Both companies report their progress as a single percentage that does not distinguish between the actual GHG impacts.

- Trading added risks and complexity for better optics – To maintain feasibility, current hourly matching proposals are not using narrow geographic boundaries that consider the deliverability of each MWh in each hour, but instead are using geographic boundaries that consider where deliverability of some electricity is possible at some point in the year.[20] While this is more feasible and improves the optics of matching claims, it is debatable whether these more flexible boundaries are narrow enough to achieve the desired claimed scientific integrity of ensuring claimed renewable energy-generated electricity is physically deliverable to the claiming company.[21][22] Are we incorporating all of the aforementioned risks in exchange for primarily enhancing the appearance of scientific integrity with these market-based proposals for stricter geographic and temporal alignment?

What is the Purpose of All this GHG Accounting?

Scope 2 corporate reporting has historically been an exercise in GHG inventory accounting. Yet, the purpose of the scope 2 market-based approach, including a shift to hourly matching, appears to be clearly fostering greater consequential avoided emission impacts from corporate financial interventions in wholesale power markets.[23] We create a fundamental problem when we attempt to recognize the impacts of interventions by accounting for them with an allocational (inventory) instead of a consequential method.

While there are many accuracy benefits and few risks associated with a move to improved location-based scope 2 methods that utilize better temporally resolved (e.g., hourly) and geographically representative grid average emission factors, this does not automatically lead to the conclusion that a shift to hourly market-based reporting will provide similar benefits without risks. The underlying purpose of market-based GHG accounting approaches is not to improve accuracy but instead to foster greater impact through corporate certificate-based and other financial interventions. So, what if the overall result of hourly market-based matching is to reduce corporate renewable energy market impacts and participation?

A Path Forward

Suppose we are successful in decarbonizing our world quickly. In that case, we will not only avoid the horrific damages of climate change but also create a future of abundant and accessible clean energy that improves the lives of billions. Accurately measuring and reporting corporate emissions is in service of this future. Incentivizing ambitious corporate action is in service of this future. Broadening impactful participation is in service of this future.

As we strive for cleaner grids, we need GHG accounting frameworks that both create accountability for reducing indirect emissions physically associated with corporate energy consumption and incentivize and recognize corporate CFE market interventions that cause grid emissions to be avoided. And we need to do so in a manner that builds on what appears to be working, like PPAs.

While well-intentioned, a blanket move to hourly market-based matching requirements (as opposed to it being valued but optional[24]) risks complicating REC procurement in a way that could hinder the momentum of renewable energy capacity expansion. A better solution would be addressing market-based REC and PPA claims by companies through a new mitigation intervention GHG accounting statement that utilizes consequential methods to quantify the avoided emissions impacts of these corporate CFE market interventions. This new type of GHG statement would align the application of the GHG accounting method with the intended uses of those reported results and claims. The GHG Management Institute is working on a detailed version of this proposal.

Ultimately, the success of an improved GHG Protocol corporate standard will partly depend on fostering a renewable energy market that achieves multiple purposes. For the purpose of incentivizing and recognizing the impact of corporate interventions in renewable energy markets via PPAs and REC procurement, it is unclear whether shifting to hourly matched RECs within scope 2 market-based inventory reporting would produce an improvement, even in the long term, relative to the status quo.

Download the Essay

Acknowledgements

This was a special collaboration with Michael Leggett at Ever.green. You can view their coverage of the essay here and follow their work at https://www.ever.green/. We are thankful for the insightful comments and discussions with Matthew Brander (University of Edinburgh), Derik Broekhoff (SEI), Greg Miller (Singularity), Lissy Langer (Technical University of Denmark), Ash Merscher (GHGMI), Keri Enright-Kato (GHGMI), Tani Colbert Sangree (GHGMI), Liz Pearce (Ever.green), Cris Eugster (Ever.green), and others. All errors and opinions are solely the authors’.

Recommended Citation

Leggett, M. and Gillenwater, M. (2025). “Limitations of Hourly Matching Claims for Scope 2 Reporting.” Ever.green and Greenhouse Gas Management Institute, May 2025. https://ever.green/papers/hourly-matching

[1] Although the precise character of this pooling is a complex function of transmission and distribution constraints, which can be made more granular through power flow tracing to narrow which generators are pooled to supply which consumers at each moment, it is not physically possible to exclusively transmit electricity from a single generator to a single end-use consumer. [2] We use “RECs” to refer to all types of Energy Attribute Certificates, including Guarantees of Origin (GOs). [3] https://www.nrel.gov/docs/libraries/analysis/nrel-green-power-data-v2023.xlsx?sfvrsn=5775598f_2. [4] Note that we are not claiming that all 200 GW of renewable energy capacity was necessarily caused to be developed by PPAs. Data from BloombergNEF, February 13, 2024. [5] Statistic excludes RECs used by Load Serving Entities for state Renewable Portfolio Standard compliance. [6] https://ghgprotocol.org/sites/default/files/standards/Scope%202%20Guidance_Final_Sept26.pdf#page=94. [7] The EPA created the eGRID subregions to support location-based GHG accounting of electricity consumption. View the map at https://www.epa.gov/egrid/maps. [8] European bidding zones division according to ENTSO-E. [9] Hourly matching could be especially helpful when considering subsidies for climate technologies like clean hydrogen or direct air capture that introduce significant new demand at specific points on the grid and rely on credible claims to be running on renewable energy at all times. [10] https://www.gstatic.com/gumdrop/sustainability/google-2024-environmental-report.pdf#page=8. [11] https://acore.org/resources/bridging-demand-and-financing-voluntary-offtake-in-clean-energy/. [12] https://www.greenstrategies.com/what-do-clean-electricity-buyers-think-about-pending-scope-2-changes/. [13] https://cebuyers.org/wp-content/uploads/2025/05/CEBA_Letter-to-Greenhouse-Gas-Protocol-ISB_23-May-2025.pdf. [14] https://entergynewsroom.com/news/entergy-arkansas-gets-green-light-for-commercial-customers-go-zero/. [15] https://www.sciencedirect.com/science/article/pii/S095965262102432X. [16] https://www.bu.edu/sustainability/projects/bu-wind/. [17] https://www.mckinsey.com/industries/…/rethinking-your-companys-clean-power-strategy. [18] https://www.ethree.com/wp-content/uploads/2024/07/E3_VoluntaryCorporateProcurement_HourlyEmissions_June-2024.pdf#page=26. [19] Google reported 67% CFE in 2020 and 64% in 2023. [20] https://singularity.energy/boundaries-report. [21] https://zerogrid.org/wp-content/uploads/dlm_uploads/2025/05/iai-deliverability-memo.pdf. [22] https://resurety.com/carbon-impact-of-intra-regional-transmission-congestion/. [23] https://ghgprotocol.org/sites/default/files/2025-02/S2-Meeting9-Presentation-20250305.pdf#page=8. [24] Ever.green actively works with partners and customers to maximize the impact of corporate REC procurement. Their latest white paper outlines a practical approach to modifying this scope 2 market-based approach, offering options that allow and reward companies that can embrace concepts like hourly matching alongside options for annual RECs when purchased in ways proven to be impactful, like PPAs.

Comments