Installment N.3

Preface

If you have not yet read the previous installments Number 1 and Number 2 in this series, I encourage you to do so before proceeding. You can think of each of these installments as a chapter in a storybook.

I have an apologetic forewarning for you as the reader. Sadly, I expect that you will find this installment annoyingly theoretical and abstract. I portend that you will think as you read, “Hey, please give some concrete examples of how this will work.” All I say now is that I very much want to provide examples and demonstrate how what I am proposing will work. But, for now, all I can offer you is acknowledgment of your annoyance. Happily, our Research Program has initiated work to develop examples, which we are eager to share with you next year.

Introduction

In the previous installment, I promised to address the question—What are the allocation rules governing physical greenhouse gas (GHG) accounting? But what do I mean by “allocation”? I argue that, properly understood, the term allocation is fundamental to GHG and broader environmental accounting. Allocation refers to the boundary setting rules and norms that assign responsibility for emissions to an accounting subject—such as a company, country, city, or facility—when applying physical allocational accounting methods (e.g., emission inventories).[1] Responsibility, here, in part entails an agreement or requirement to document and/or report assigned emissions.

This definition of allocation differs and is broader than that used in the product life cycle assessment (LCA) literature, which more narrowly refers to allocation only as the apportioning of emissions released from a single process to each of a set of co-products that the single process produces.[2] The GHG Protocol Scope 3 guidance uses the term “allocation” similarly, as only something that occurs when a company assigns emissions to its various products so that they can then be further allocated downstream to its customers to estimate their Scope 3 emissions from upstream product purchases.[3] However, this view of allocation adopted from product LCA is mistakenly narrow. When we set the GHG inventory accounting boundaries for a company we are choosing what emissions that company will be allocated responsibility for. The same logic applies to other types of accounting subjects, such as countries, cities, facilities, or products.

It is critical to bear in mind that assigning responsibility through allocation rules does not mean that a GHG inventory accounts for all emissions that a subject does or could influence through its actions. How allocational GHG accounting boundaries are delimited is a key distinction between allocational[4] (inventory) and consequential (intervention) accounting methods. The former will not account for all emissions that a subject does or can influence. The “ability to influence” is a poor delimiting rationale for emissions inventories because a company can indirectly influence a near-infinite range of emissions through its decisions and actions. Necessarily, some corporate actions will influence emissions occurring outside of their inventory accounting boundaries (i.e., emissions not allocated to the company). To assume that a GHG inventory will account for every effect on emissions that every action a company takes – is a methodological fantasy. Yet, it is this fantasy that is the explicit basis for the boundary setting framework in the GHG Protocol Scope 3 guidance. One result of embedding this fantasy into an accounting protocol (i.e., Scope 3) is that indirect emissions are duplicatively allocated to every company that chooses to report them. I will be further discussing the implications of this problem in a future installment.

In contrast, the accounting subject of consequential accounting methods is an intervention. And each intervention’s GHG accounting boundaries extend to whatever processes are influenced by the intervention, while processes that remain unchanged by the intervention (i.e., are the same in the intervention and no-intervention scenarios) are omitted.

Returning to allocational methods (inventories), the next logical questions are—What rationale should be used for the allocation of emissions to subjects? Would any allocation be equally valid? Can emissions be allocated at random to companies? Why should a company be assigned responsibility for some emissions and not others? Is allocation done in an exclusive or non-exclusive manner? Clearly, rules are needed that have a logical basis and that are tied to the purpose of the GHG reporting. The GHG Protocol corporate standard largely evades answering these questions and instead offers enormous flexibility in boundary setting approaches, leaving companies with the challenge of formulating their own answers.

I argue that the first rule should be that allocation for GHG inventories should not be based on consequential thinking because doing so inhibits our ability to properly differentiate allocational (inventory) and consequential (intervention) methods. Fundamentally, GHG inventories should involve the assignment (i.e., allocation) of responsibility for emissions to individual subjects and do so repeatedly and consistently over time such that meaningful trends can be observed.

Further allocation rules are relatively uncomplicated where only direct emissions are considered because they will unambiguously correspond to the subject’s demarcated physical boundaries. For example, under the GHG Protocol corporate standard, the allocation boundaries for Scope 1 emissions are determined by the physical organizational boundaries of the company.[5] Another example is illustrated with territorial-based GHG emission inventories, such as those prepared for nation-states under the United Nations Framework Convention on Climate Change (UNFCCC), which allocate emissions based on where they are geographically emitted to the atmosphere (i.e., the physical boundaries of the subject, which in this case is a country’s territory). However, choosing allocation rules becomes significantly more complicated when indirect emissions are included because emissions allocation boundaries and the subject’s physical boundaries no longer coincide. Accounting for indirect emissions also introduces greater potential for a single unit of emissions to be assigned to multiple subjects (i.e., double counted) due to overlapping accounting boundaries.

Though direct emissions are uncontroversially allocated based on physical location and the physical boundaries of the accounting subject, such clear consensus is lacking for the allocation of indirect emissions. One cleavage in the options for allocation rules for indirect emissions involves the use of financial versus physical (i.e., matter and energy) connections to a subject as the basis for allocating emissions to that subject. This cleavage is discussed next.

Physical vs. financial allocation

Again, our focus here is on allocation rules for physical GHG inventory accounting, not consequential or performance GHG accounting. The physical inventory form of GHG accounting quantifies the physical releases to the atmosphere that are allocated to subjects as well as totals across those subjects. The latter two do not. So, what should be the rationale for allocating physical emissions to subjects, such as companies?

Many of the debates on corporate GHG reporting fundamentally involve arguments for using financial relationships and transactions as a basis for the allocation of indirect emissions as an alternative to physical connections. In other words, allocating the emissions from a process to a company as indirect emissions based on a financial transaction versus allocating based on a physical flow of matter or energy from that process to that company. However, before exploring these allocation alternatives, we must differentiate between: i) defining an accounting subject and ii) allocating emissions to that subject. The GHG Protocol for corporate reporting refers to these two concepts as organizational boundaries and operational boundaries, respectively. Where companies are the subject of emissions accounting, it is patently appropriate that financial factors will be used as a basis for characterizing a company as a subject (i.e., what assets and activities are embodied by a company). Which financial and other factors are used for this characterization will appropriately depend upon the specific purpose of the corporate GHG reporting. Since these organizational boundaries determine the assets that are embodied by the company, they establish the allocation of direct emissions to that company. However, organizational boundaries do not establish allocation rules for indirect emissions, as these emissions physically occur beyond the physical boundaries of the company. So, the more specific question is what role should financial factors play in allocating indirect emissions to a company?

Along with mistakenly approaching corporate GHG reporting as a form of LCA,[6] I argue that another flawed concept is to interpret corporate GHG inventory reporting as analogous to financial accounting. Although both domains use math and the term “accounting,” the similarities mostly cease there. Financial accounting addresses a social construct—money—which is not constrained by the laws of physics or chemistry. For example, we can make money appear or disappear by fiat. But, tonnes of CO2 do not disappear from existence just because we simply deem it so. Although financial accounting practices have useful lessons to provide for GHG accounting on topics such as auditing and governance, it is not clear that there are any useful lessons from financial accounting for answering questions on allocation in physical GHG accounting. Therefore, attempts to marry GHG accounting with financial accounting should be limited to the domain of carbon pricing, applications of economic environmental accounting, and scoring within a performance GHG accounting framework (see Installment N.2).

The implication of using financial or legal relationships as a basis for allocating indirect emissions to companies is that allocation, or reallocation, could then occur through any imaginable financial transaction or legal arrangement, irrespective of the physical connections with the physical assets and activities of a company. I argue that physical environmental accounting quickly becomes environmentally meaningless when it is divorced from physical connections. For example, the use of product prices or other measures of economic value to determine allocation thwart physical GHG accounting by tying it to the social and irrational elements of market prices such as luxury brand values. Instead, I argue that allocation of indirect emissions in physical GHG accounting should be constrained by a requirement for physical connection with the subject (e.g., company) in the form of and proportional to physical matter or energy flows. Therefore, the assignment of responsibility to companies (or other subjects) for emissions within GHG inventories should not be purely done on the basis of financial factors or contractual agreements.

While I argue excluding financial factors from allocational (inventory) GHG accounting, this is not the case for consequential (intervention) accounting. Financial factors, including the modeling of economic relationships, are appropriate for use in consequential GHG accounting methods. First, interventions themselves can be financial in character, and economic relationships are often affected by an intervention being assessed. In other words, consequential methods will often include market-mediated effects (e.g., impacts on supply and demand). This is a key distinction between these two forms of physical GHG accounting—simply because financial relationships are used in one form of GHG accounting (i.e., physical consequential) does not mean they are appropriate to be used in another form (i.e., physical allocational). More practically, physical matter and energy flows may or may not have financial transactions associated with them, and the allocation of indirect emissions for physical GHG inventory accounting should be indifferent as to whether they do or do not.

It is easy to rationalize allocation rules by thinking that connections with a company that “cause” emissions should result in those emissions being allocated to the company. However, I argue that we should consciously avoid justifying allocation rules with such causal thinking. First, doing so is unnecessary to resolve inventory allocation questions. Second, doing so problematically introduces consequential thinking (i.e., how did action A influence action B) into allocational methods. The subjects for physical allocational GHG accounting are entities or objects (e.g., companies, organizations, cities, countries). While the subjects for physical consequential GHG accounting are actions, which we refer to as interventions. Although actions are taken by entities, it is not an entity that is the subject of the accounting when applying consequential methods. For example, a company does not cause emissions simply by existing. A company’s actions, such as the use of its assets, cause emissions. This point may seem unnecessarily metaphysical, but it is critical that we establish distinct rationales for boundary setting and allocation rules for consequential and allocational methods. Many of the errors in GHG accounting relate to the conflation of consequential and allocational thinking and methods (e.g., applying marginal emission factors to a GHG inventory).

So, is my argument that the use of financial data should be entirely forbidden in physical allocational GHG accounting? No. However, the use of financial data in GHG inventories should only be justified in cases where physical flow data is unavailable or of relatively poorer quality than the best available proxy data for estimating those physical flows. In some cases, the best available proxy data may be in the form of financial data. In such cases, financial data may be used, but only to approximate data on physical flows—not as the underlying basis for allocation.

Requiring a physical connection for allocation in physical GHG accounting, however, does not fully answer the indirect emissions allocation question. It is a necessary but insufficient rule because physical connections to a company can potentially go on without limit. Ultimately, if mapped through enough degrees of separation, everything in the physical world can be shown to be physically connected to everything else.[7] In the context of corporate Scope 3 emissions, a physical connection will not uniquely determine how to allocate indirect emissions across companies in a supply chain. Nor will it address the question of whether the allocation of emissions should be exclusive or non-exclusive. Once the physical connection requirement is met, then a range of allocation rules would be acceptable and selected in keeping with the intended function and application of the reported data estimated using a physical allocational GHG accounting method (see Installment N.2). To illustrate, we will be developing examples for some industrial sectors in the coming months.

To guide the further selection of application-specific boundary setting and allocation rules, I next introduce two other concepts: 1) the accounting boundary for a population of accounting subjects and 2) additivity. Integrating these two concepts into GHG accounting frameworks, such as the GHG Protocol corporate standard, will help achieve comparable and temporally consistent GHG emission inventories.[8] Their application also supports exclusive allocation (i.e., no double counting).

Before exploring these concepts, it is valuable to explain activity pools. An activity pool exists where a physical matter or energy flow (i.e., connection) is pooled in such a manner that it cannot be separately traced from each emitting process to each accounting subject (e.g., a company). The most well-known example is the delivery of grid-connected electricity to consumers, but other examples include natural gas utility distribution networks as well as some agricultural commodities where the origin of the commodity is untraced. Brander and Bjørn (2023) present two cases of activity pools: i) inherently untraceable (e.g., grid electricity, pipeline gas) and ii) practically untraceable (e.g., commodity aluminum billets). The question with such activity pools is how companies that consume these products should be allocated upstream indirect emissions from their production.[9] The obvious default is where traceability is not possible, all consumers of the commodity should be allocated emissions assuming an average emission factor for that pool. Any alternative would entail a company falsely claiming that it had some type of exclusive physical connection with a supplier to the activity pool. This issue is at the root of the long-running debate over corporate Scope 2 emissions accounting and the market-based approach to allocation (Brander et al., 2018). I will be exploring the question of market-based approaches as a subset of the broader question of allocating indirect emissions in a coming blog installment.

One final note before exploring the two new concepts in the next sections. This blog installment focuses on the physical allocational form of GHG accounting (i.e., GHG inventories). As discussed in the first installment which furnishes definitions of GHG accounting, performance GHG accounting rules are not constrained by the same norms as physical forms for GHG accounting. Instead, performance accounting rules are set in whatever manner that furthers the objectives of the policy or program that the accounting rules support. This is acceptable because performance GHG accounting scores are not intended to equal the factual physical emissions to the atmosphere nor physical avoided emissions, although its scores may be derived from either or both. For example, an emission source that a regulation wants to strongly disincentivize could receive a compliance score as if it emitted 2 tonnes of CO2 for every 1 tonne it actually emitted. This quantification is not a physical reality, but it may further the applicable policy objectives that the accounting supports.

Subject and population boundaries

Organizational boundaries, as described in the GHG Protocol, define what a company is and thereby set the accounting boundaries for direct (Scope 1) emissions. Operational boundaries, as described in the GHG Protocol, then extend the emission accounting boundaries to include indirect emissions (i.e., Scopes 2 & 3). I refer to operational boundaries generically as the accounting boundaries of an accounting subject (e.g., company, country, or city). In other words, accounting boundaries determine what emissions a company is allocated responsibility for. The term “system boundaries” is used in LCA to refer to the same fundamental concept of accounting boundaries. For product LCA, system boundaries are meant to include all the emitting processes occurring within a notional “life cycle” of a product. Similarly, the GHG Protocol corporate standard’s operational boundaries are meant to include all upstream and downstream emitting processes occurring within a notional “value chain” of a company.

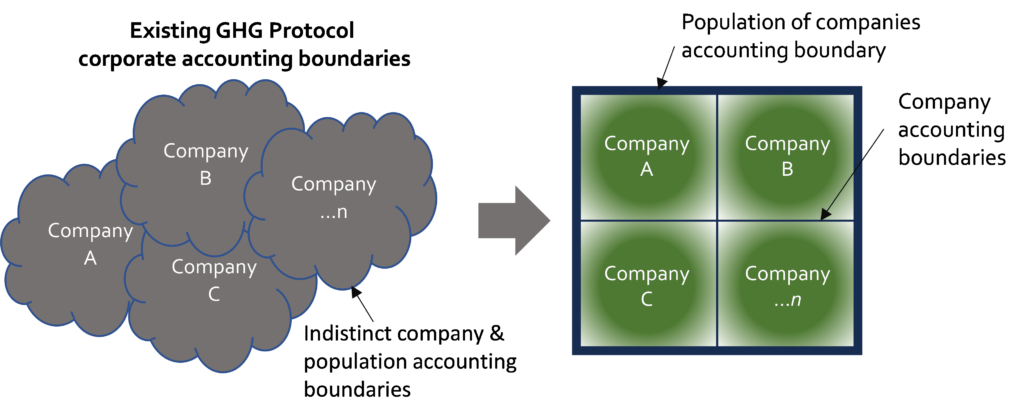

But there is a potent concept missing in both product LCA and the GHG Protocol corporate standard —the broader accounting boundaries for a population of accounting subjects (e.g., a group of companies). In line with its neglect of the principle of comparability, corporate GHG accounting under the GHG Protocol addresses each company and its accounting boundaries in isolation with respect to other companies. Yet, if we are interested in comparability across companies, then we must think in terms of a hierarchy of system boundary layers—the accounting boundaries for one company and the larger encompassing boundary for a population of companies. The existing approach to operational boundaries and Scope 3 in the GHG Protocol only addresses the boundary of an individual company, and even there it does so in a subjective and ambiguous manner. For example, it is not currently possible to objectively determine if a corporate inventory completely reports all scope 3 emissions.[10] For the concept of population boundaries to be applied, a reduction in this subjectivity and ambiguity in the GHG Protocol’s guidance on the accounting boundaries for individual companies is required (see Figure 1).

Figure 1: “Fuzzy” GHG Protocol corporate GHG accounting boundaries versus delineated corporate boundaries within a wider system boundary of a population of companies.

There is nothing inherently wrong with establishing the boundaries for an emissions accounting framework that encompasses only one company, as the current GHG Protocol corporate standard does. However, such an accounting system only allows comparisons of emissions and emission trends among component parts within that single company (e.g., across business units, departments, facilities, and emission sources). It will not support comparisons across different companies. In other words, each company is effectively an accounting island.

It is inherent to the definition of physical allocational GHG accounting that emission inventories be comparable across accounting subjects. Allocating emissions in a manner that obstructs comparability across subjects is contrary to this definition. The existing GHG Protocol corporate standard does not provide comparability across companies, but it could instead support comparability across component parts of a single company.[11] Unfortunately, the GHG Protocol does not outline how internal corporate components (e.g., business units) should be defined to establish comparability. Therefore, comparability, both within a company and across companies, is essentially forsaken by GHG Protocol corporate guidance. What the Protocol does focus on is reporting a consistent time series of total corporate emissions for each individual company and then target setting and tracking via repeated annual emission inventories. But what is inappropriate within the current corporate reporting practices is comparing emission totals or trends across companies.[12]

To achieve comparability across companies, a proper physical allocational GHG accounting framework must unambiguously delimit accounting boundaries for both its subjects and the encompassing population of subjects it addresses. Such delimiting is necessary to avoid the problems inherited from LCA of infinite regress and progress (i.e., scope 3 boundaries that have no distinct upstream or downstream limits) as well as duplicative allocation of emissions created by overlapping accounting boundaries across companies in a population (i.e., many companies report the same scope 3 emissions). So, in practice, how far upstream and downstream should a company be assigned to report indirect emissions under an allocational accounting framework that supports comparability across a group of companies in the same designated population? Relative to the existing GHG Protocol and Scope 3 guidance, significantly greater delimiting constraints on the indirect emissions allocated to a company are needed, especially given the complex reality of supply chain networks in most industrial sectors. In other words, we need to rein in Scope 3 to include a far more limited assignment of indirect emissions to each company. More broadly, we need to abandon the wishful thinking that comparable and meaningful GHG accounting results can be produced by attempting to perform an LCA on an entire company.

What about delimiting constraints for the broader boundary of a population of companies—what companies should such a population include? If our population includes all companies in the world, then achieving comparability is indeed impractical. Unfortunately, many use current corporate GHG reports in this manner anyway. However, we are not limited to the binary choice of: i) a retreat to an utter lack of comparable reporting across companies or ii) the fantasy of comparable corporate GHG reports across all companies in the world.[13] Instead, a practical and balanced solution is to purposefully select a group of companies, for which comparability will be both meaningful and useful, for inclusion in a designated population.

So then, on what basis should companies be selected for a designated population that is assigned to use the same emissions allocation and other GHG accounting rules? One logical basis is to include only companies (or major business units in diversified companies) that are in the same industrial sector, and therefore for which comparisons provide meaningful information. Therefore, within that sector (e.g., steel production), corporate reports would be comparable across companies, and importantly, the aggregate emissions of the population of companies would also deliver a meaningful time series for tracking sectoral progress. The overall corporate GHG accounting framework would then contain multiple separate sector-specific populations, each with sector-specific emissions allocation rules. Put more simply, assuming it is possible, what purpose is there in trying to compare the physical emissions allocated to a software company to those allocated to a cement manufacturer (see Installment N.2)?

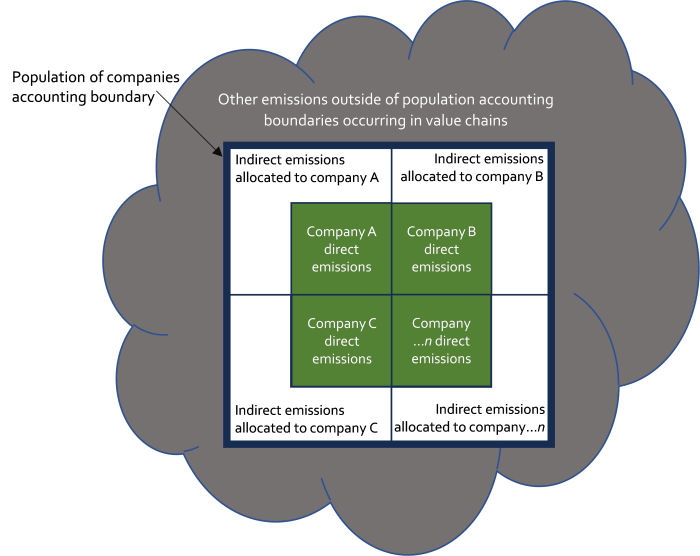

For the companies included in a population (e.g., industrial sector) to report comparable direct emissions, they will need to apply the same organizational boundary setting rules (i.e., “consolidation approach” in the GHG Protocol). But then to also report comparable indirect emissions, these companies will need to apply the same accounting boundaries specifying what indirect emissions processes to include. Each sectoral population will likely have differing indirect emission sources and therefore different indirect emission accounting boundaries. And in all cases these boundaries will need to be far more limited than the vaguely defined “minimum boundaries” described in the GHG Protocol Scope 3 guidance (Figure 2).[14] Exploring and testing this approach to accounting boundaries is the focus of ongoing research.

Figure 2: Illustration of a delimited company (i.e., subject) and population of companies accounting boundary. The green and white squares represent emissions that are exclusive and comparable across companies.

As illustrated in Figure 2, proper physical allocational GHG accounting frameworks will not attempt to include indirect emissions that are distantly or purely financially connected to a subject (e.g., company). These emissions cannot practically be quantified repeatedly with meaningful sensitivity to process changes over time. An obvious rebuttal, however, is that under a more delimited accounting framework companies can “get away with” outsourcing their emissions by shifting emissions-producing-processes outside their company and population accounting boundaries. My retort to this rebuttal is that unless our inventory accounting subject is the Earth itself, then it is unavoidable that emissions can potentially be shifted to another inventory accounting subject. Properly understood, this rebuttal is just another way of arguing that GHG inventories should account for all changes in emissions that a subject (e.g., company) could be viewed as influencing, which is without limit, impractical, and grounded in consequential thinking. Emission inventories must have limits and those limits should be comparable across accounting subjects. In practice, though, the choice of which indirect emission sources to include in the population accounting boundaries should address typical outsourcing configurations within the sector, while still aiming to achieve the principle of comparability across companies.

Instead, the GHG Protocol adopted from LCA the aim of accounting for any shifts of emissions from one part of a single company’s value chain to another part.[15] But, this adoption came at the extreme price of giving up on producing meaningful and comparable estimates.[16] There is no single physical GHG accounting framework that can both produce meaningful emission totals with time series consistency and quantify the emissions impact of every action a subject takes. It is unavoidable that actions that companies will take can, and likely will, affect emissions outside of their reasonably defined subject and population allocational accounting boundaries.[17]

The choice of which indirect emission sources to include in corporate (i.e., subject) and sectoral (i.e., population) accounting boundaries must be constrained, again, by the requirement for a physical connection between the company and each physically emitting process through some combination of matter and/or energy flows (e.g., transfer of physical goods). This same requirement should apply to all applications of physical allocational GHG accounting. Other sector-specific allocation rules must also be specified to further delimit the list of indirect emission sources to allocate. These added allocation rules should be in keeping with the intended function and application of the accounting time series data at both the subject and aggregate population scales. An application here means, for example, a GHG reporting protocol that is assigning responsibility for emissions to a group of companies and tracking their progress in meeting a sectoral reduction pathway. In practice, these added rules should also limit the accounting boundaries to proximate indirect emission sources (e.g., direct emissions from select tier 1 customers and suppliers[18]) for which emissions can be estimated based on process-specific data versus spend-based data.

Lastly, we should recognize that corporate GHG reporting is typically an exercise that is voluntary or, in rare instances, limited to a few companies selected for regulation. Based on this reality, for a given industrial sector, some companies are unlikely to participate in reporting (e.g., no universal coverage of all companies in an industrial sector). Nonetheless, population (e.g., sectoral) emission totals can still provide a meaningful time series of aggregate progress as well as support the development of sectoral decarbonization pathways and climate clubs.

The next section will discuss the concept of additivity, which is the property created when a GHG accounting framework properly addresses double counting and exclusively allocates emissions. We will be considering additivity not in a global sense (i.e., the sum of emissions from all subjects equals total global emissions), as this is an asinine concept when our accounting subjects are companies (i.e., the world is made of more than just a collection of companies). Instead, we will consider only additivity for companies in a designated population, which requires each company in a population to have non-overlapping accounting boundaries.

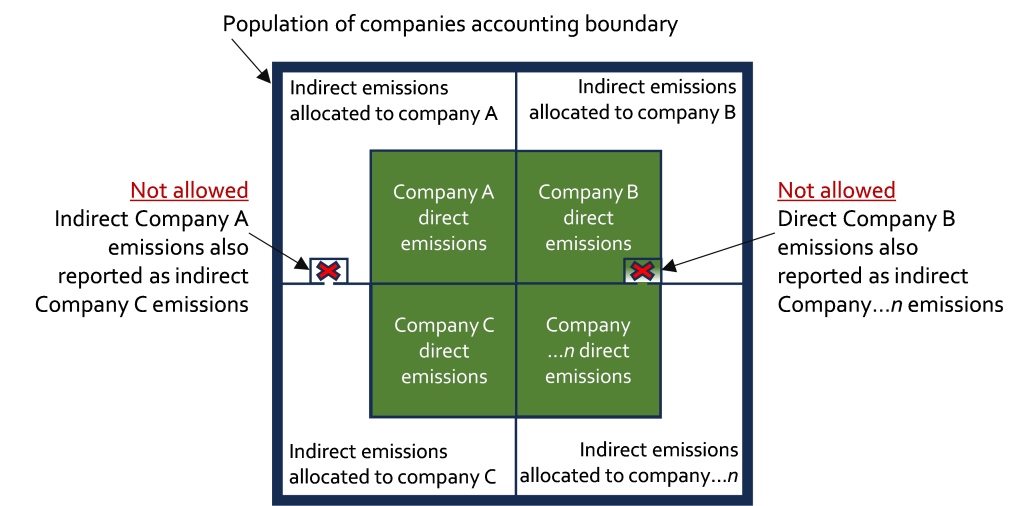

Additivity

Additivity is a property of an accounting framework in which the aggregated output of separate subjects is equal to the sum of their individual outputs (i.e., the sum of the parts equals the whole). In other words, the total emissions allocated to a population of companies can be calculated by summing up the emissions allocated to each individual company. I argue that the property of additivity is central to physical allocational GHG accounting. It supports comparison across accounting subjects and enables metrics to be produced on shares of a whole (i.e., one company’s contribution to aggregate sectoral emissions). Additivity requires a clear and exclusive allocation of emissions to subjects within an accounting population (i.e., no double counting of emissions between subjects in a designated population, as illustrated in Figure 3).

Figure 3: Additivity and avoiding double counting within population accounting boundaries.

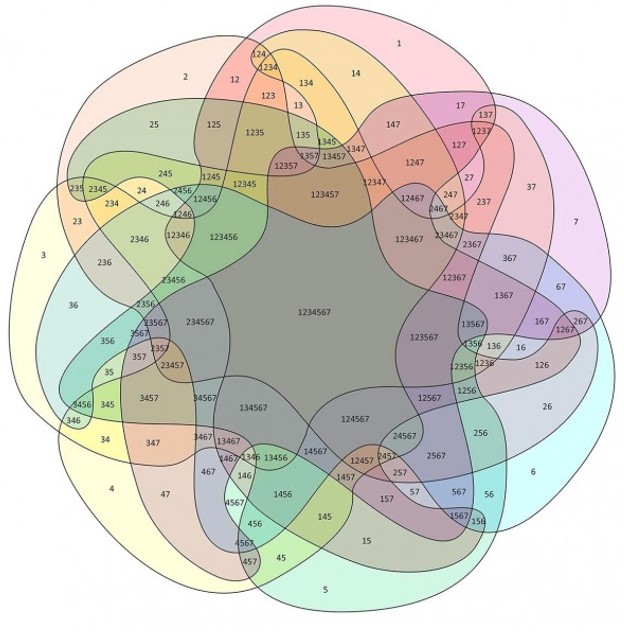

The existing practice for reporting Scope 3 emissions by companies using the GHG Protocol results in duplicative reporting across companies. One can envision the existing Scope 3 accounting boundaries of companies as a confounding Venn diagram (Figure 4). An obvious implication of this duplication is that existing corporate GHG inventory reporting lacks additivity across reported Scope 3 emission totals. This extensive double counting of indirect emissions across companies is justified in the GHG Protocol Scope 3 guidance with the argument that multiple companies can often influence the same value chain emissions.[19] But, as discussed previously, “influence” is a highly problematic concept upon which to decide allocation and boundary setting rules.

Figure 4: Interpretation of overlapping Scope 3 accounting boundaries for 7 companies as a 7-subject Venn diagram [20].

There are two dimensions to additivity. The first is isolated to one company (i.e., subject) and is additivity of emissions across each component of one company’s value chain (e.g., no double counting within reporting of Scope 3 emissions by a single corporation). It is this first dimension of additivity that the existing GHG Protocol strives to achieve.[21] However, the ambiguous boundary rules of existing GHG Protocol Scope 3 accounting guidance render this dimension of additivity functionally meaningless.[22] The second dimension of additivity is the total across companies, which is the focus here.

The literature on environmental accounting generally interprets the property of additivity in terms of a summing of emissions from products, companies, or other subjects to total global emissions. However, such an interpretation is only logical for exceptional physical allocational GHG accounting subjects, such as countries under national anthropogenic GHG emission inventories (IPCC, 2006).[23] Given that all of humanity’s activities do not fall under a corporate umbrella, the notion that all corporate emissions should add up to a global total is ludicrous. However, by applying the concept of population accounting boundaries (e.g., by industry sector), we can interpret additivity in a more practical manner.

For corporate GHG accounting, the property of additivity across companies is most reasonably and usefully applied separately for each population at the industrial sector scale. Company accounting boundary setting (i.e., what select indirect emissions are allocated to a company) then becomes a question of accounting rules tailored for each sector, versus the existing GHG Protocol approach that allows each company to separately set its accounting boundaries in a bespoke manner. This new approach results in a sectoral accounting framework that can meaningfully support sectoral target setting (e.g., science-based targets) and sectoral budgets for companies participating in a GHG reporting program.

Final comments

Returning to the questions posed at the outset: What rationale should be used for the allocation of emissions to subjects? We should avoid relying on consequential thinking and justifications for allocation, as well as not base allocation on financial relationships or connections. Instead, allocation rules for indirect emissions should require a physical connection and be proportional to the matter or energy flows of that connection. Would any allocation be equally valid? Can emissions be allocated at random to companies? Why should a company be assigned responsibility for some emissions and not others? Allocation rules should be constrained to achieve additivity across a designated population of companies (e.g., within a common industrial sector) to achieve comparability in reporting across companies in that population. Further accounting rules then should be selected based on the intended application of the reported physical inventory estimates. Is allocation done in an exclusive or non-exclusive manner? Additivity cannot be achieved without exclusivity. Further, a lack of exclusivity dilutes the objective of assigning responsibility.

Again, I recognize that this installment reads annoyingly abstract, and I apologize. Work has begun to construct concrete examples for specific industrial sectors, which we plan to publish next year. Beforehand, I will be releasing further blog installments on market-based approaches to GHG accounting, why modeling corporate GHG accounting on LCA is highly problematic, and an alternative to Scope 3 that instead accounts for the impacts of corporate interventions in and beyond their value chains.

I will leave you with one teaser of an upcoming installment. It is repetitively proclaimed that the vast majority of emissions from companies are in Scope 3. But, this well-accepted claim is based on faulty logic. The error should be obvious once you realize that the same emissions are being reported by numerous companies under Scope 3, which is not the case with Scope 1 and 2. You can make any category appear large relative to other categories if you multiply the size of the category by a large enough number. Therefore Scope 3 appears as the larger portion for two reasons. The first is this enormously duplicative reporting of Scope 3 across companies. The second reason you will have read the coming installment to find out. Click here to receive the GHGMI newsletter and to receive forthcoming installments in the “What is GHG Accounting” series.

Click here to read all the posts in the “What is GHG accounting?” series

Acknowledgments

I am thankful for the insightful comments from and discussions with my colleagues Matthew Brander (University of Edinburgh), Anders Bjørn (DTU), Tani Colbert-Sangree (GHGMI), Molly White (GHGMI), and Keri Enright-Kato (GHGMI). GHGMI is grateful to Salesforce for supporting this research.

Recommended Citation

Gillenwater, M., (2023). What is Greenhouse Gas Accounting? Allocation rules. Seattle, WA. Greenhouse Gas Management Institute, October 2023. https://ghginstitute.org/2023/10/11/what-is-greenhouse-gas-accounting-allocation-rules/

References

Brander, M., Bjørn, A., 2023. Principles for accurate GHG inventories and options for market-based accounting. Int J Life Cycle Assess. https://doi.org/10.1007/s11367-023-02203-8

Brander, M., Gillenwater, M., Ascui, F., 2018. Creative accounting: A critical perspective on the market-based method for reporting purchased electricity (scope 2) emissions. Energy Policy 112, 29–33.

Finnveden, G., Hauschild, M.Z., Ekvall, T., Guinée, J., Heijungs, R., Hellweg, S., Koehler, A., Pennington, D., Suh, S., 2009. Recent developments in Life Cycle Assessment. Journal of Environmental Management 91, 1–21. https://doi.org/10.1016/j.jenvman.2009.06.018

IPCC, 2006. 2006 IPCC Guidelines for National Greenhouse Gas Inventories. Intergovernmental Panel on Climate Change, Hayama, Kanagawa Japan.

Levasseur, A., Lesage, P., Margni, M., Deschênes, L., Samson, R., 2010. Considering Time in LCA: Dynamic LCA and Its Application to Global Warming Impact Assessments. Environ. Sci. Technol. 44, 3169–3174. https://doi.org/10.1021/es9030003

WRI/WBCSD, 2011. Corporate Value Chain (Scope 3) Accounting and Reporting Standard. Washington, DC and Switzerland.

Comments