This blog is not strong on subtlety. Whether you’re a committed reader or a casual “skimmer,” you have likely gleaned that we use this forum to highlight our vision for greenhouse gas measurement and management. Central to this vision, and at the heart of the Institute’s mission, is the critical need to build the capacity to measure, report, and verify GHG emissions.

If you’d like to refresh your memory on this topic, refer to:

- How we do international capacity building;

- Who is building our global GHG MRV infrastructure?; and

- Sink or swim? Given the political reality of climate change policy – what do we do now?

In recent years our observation of this capacity gap has been coupled with the lament that few decision makers acknowledge — let alone plan or take action to mitigate — this shortfall. Fortunately, as the climate change policy community has taken a contemplative step back over the last few months, the question of capacity building seems to finally be attracting attention beyond standard political lip service. References are still scant, but we would like to draw your attention to the conclusions of three recent expert multi-stakeholder climate change policy needs assessment exercises undertaken by the World Resources Institute (U.S.), the National Institute of Standards and Technology (U.S.), and Parhelion Underwriting with Standard & Poor’s (U.K.).

Last spring, Institute Dean Michael Gillenwater and I added our voices to two of these mapping initiatives. In March, Michael attended WRI’s “First International Workshop of GHG Protocol Programs” a two-day conference in Washington, D.C. where he facilitated a panel on inventory quality assurance and participated as a discussant in a session titled “Training & Capacity-Building: Scaling Up GHG Accounting Expertise.” A few months later in June, I participated in NIST’s “GHG Emissions Quantification and Verification Strategies Workshop” at Scripps Oceanographic Institute in La Jolla, California (poor me), where I was a part of a two-day mapping breakout session considering GHG measurement needs as they relate to carbon market applications. A few days later in London, U.K., Parhelion Underwriting and Standard & Poor’s convened yet another mapping exercise to assess the probability and severity of risks facing “climate finance.” Needs assessment is a painfully modest first step that in its own right does not guarantee action. Yet we are cautiously optimistic to see others bring interest to this long overlooked, but critical component of climate policy implementation.

The final reports from the two U.S. meetings are forthcoming. In the meantime, draft summaries can be found at the following links:

- WRI “First International Workshop of GHG Protocol Programs”

- NIST “GHG Emissions Quantification and Verification Strategies Workshop”

You can also download the following short report from the Parhelion Underwriting/Standard & Poor’s roundtable: “Can Capital Markets Bridge the Climate Change Financing Gap?”

We look forward to providing a deeper treatment of the findings and actions coming out of these and similar needs assessment exercises in the coming months. While we wait for these reports to be finalized, we thought it would be valuable to draw your attention to some of the preliminary conclusions we found particularly compelling.

WRI’s “First International Workshop of GHG Protocol Programs”

As climate policy becomes a reality in industrialized and developing countries around the world, many emerging economies are adopting voluntary national GHG mitigation targets and identifying the policies and measures to best achieve them. These trends point to the need for greatly enhanced GHG accounting capacity and tools at a global scale to ensure that mitigation actions can be measurable, reportable and verifiable.

As demand for GHG information increases, a cadre of qualified professionals will be required to provide a range of GHG-related services. Therefore, a strong push to innovate more efficient models of capacity building on GHG accounting, inventory quality assurance, and verification is required. Local educational institution partnerships, certification programs, and increased training of verifiers will address these capacity needs.

NIST’s “GHG Emissions Quantification and Verification Strategies Workshop”

Global GHG MRV is a new field that faces significant challenges as it begins to increase in scale to address the challenge of validating emissions reductions. Some of the issues include limited institutional capacity, insufficient corps of skilled practitioners, lack of clear training pathways, and inconsistent capacity from country to country. Improvements are required to assure policy makers, the public, and emissions market participants of the veracity of GHG markets. In particular, an increase in the number of training programs, the number of investments in the longer-term academic structure, and the facilitation of standards development would be helpful in boosting world MRV capacity.

Parhelion Underwriting/Standard & Poor’s Climate Change Financing roundtable

If our roundtable participants are indicative of the industry groups they represent, funders and investors in climate change financing are also concerned that a lack of a well-trained workforce to implement projects (that is, Human/Operational risk) will significantly affect the willingness to invest. The roundtable consensus was that policymakers should develop an integrated policy that not only creates a high-level framework for climate change finance, but also a supporting operational infrastructure. Equally this provides a demand signal to industry to develop the necessary skills and competencies necessary for the implementation and delivery of climate finance.

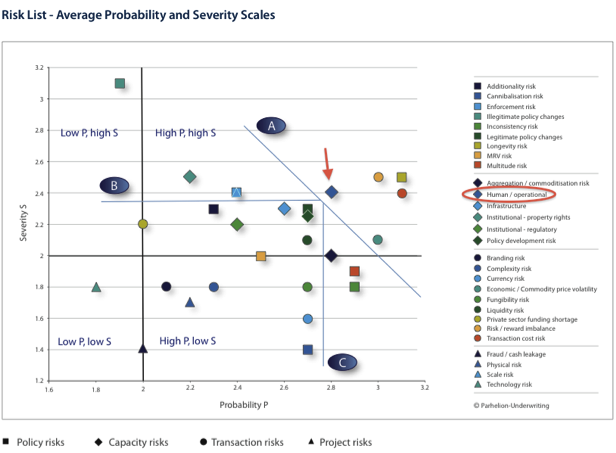

In addition to the above quote, the Parhelion Underwriting/Standard & Poor’s report also includes the below chart (“Risk List – Average Probability and Severity Scales”), which graphically maps climate finance risks with respect to severity (vertical axis; “S”) and probability (horizontal axis; “P”). Of the risks included in their roundtable assessment, note the position of Human/Operational risk (defined as “lack of well trained work force to implement projects”), which I have highlighted with a red arrow. Given the high probability and severity Human/Operational risk poses to climate financing, the report’s authors have chosen to underscore its significance by grouping it with other high impact risk factors (delineated in area “A” on the chart).

The authors further include the following explanatory note:

According to Parhelion’s analysis, while all risks should be carefully considered and managed when considering a climate change financing investment, it is appropriate for policymakers to initially focus their attention on those risks with the highest probability and severity (the area of the chart marked “A”).

As this blog has and will continue to document, the Institute is deeply committed to the expansion of GHG capacity building. As such we are pleased to see an NGO, a government entity, and the private sector separately mapping the importance of bolstering MRV capacity. Indeed we’ll be curious to see what recognition capacity building garners in those to-be-published final reports.

Though, while a rhetorical shift is welcome, we are far more interested in the details of follow-on substantive actions and eagerly await the opportunity to seriously engage the challenges of capacity building. In the meantime we will continue to be both ardent advocates for and early implementers of an underserved component of climate policy deemed essential by a growing drumbeat of experts.

Comments