Article published on Bloomberg.com and reposted with no changes.

“Companies say they’ve made climate progress. But the science says otherwise. Here’s how creative math has fueled corporate claims.

Many of the world’s largest companies are declaring breakneck progress in the fight against climate change. While their environmental handiwork shows up on paper, these gains often fail to materialize in the atmosphere.

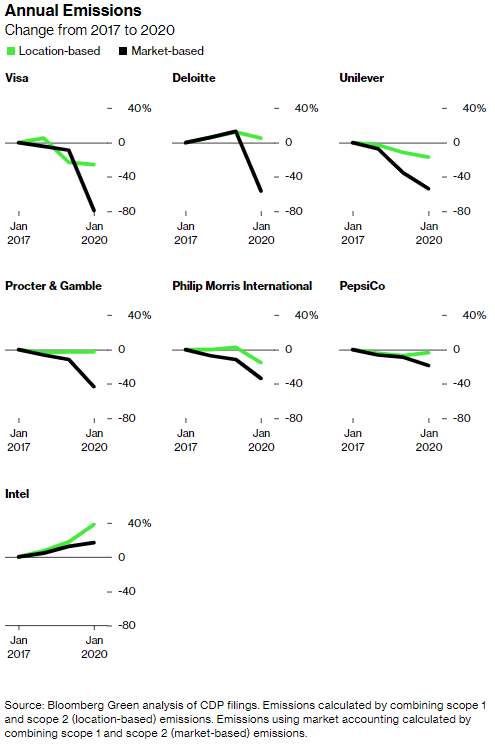

Procter & Gamble Co. vowed to cut its heat-trapping emissions in half by 2030, before announcing it had surpassed its target a decade early. Cisco Systems Inc. recently said it had exceeded a goal to reduce its climate pollution by 60% over 15 years. Continental AG, the German tire and auto parts juggernaut, claimed it had slashed greenhouse gases by an astounding 70% in 2020.These appear to be exactly the kind of giant leaps needed to forestall the most destructive impacts of climate change. But a substantially different picture emerges when using a different accounting method that more accurately measures the pollution from a company’s operations. Procter & Gamble more realistically cut its emissions by 12%, Continental’s pollution fell a more pedestrian 8%, and Cisco’s actually climbed 22%.

In the cases of each of these companies—along with similar claims made by hundreds of others—they’re relying on a common, but controversial, form of climate bookkeeping known as “market-based accounting.” This allows businesses to buy credits from clean energy providers to say they’re running on green power when they actually aren’t, wiping from their ledgers vast quantities of pollution caused by the electricity powering their offices, data centers, and factories.

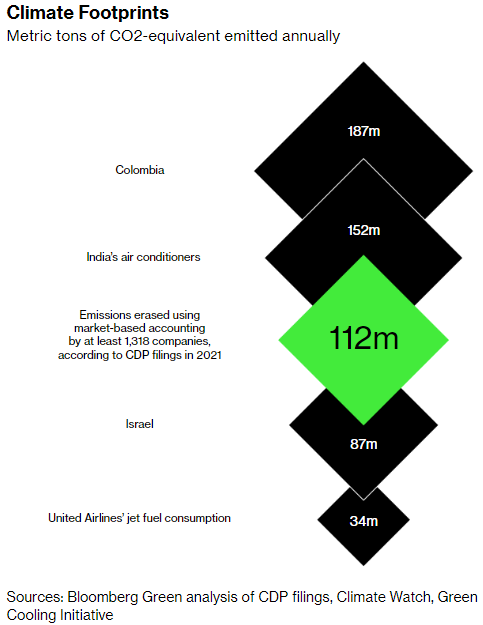

In the broadest investigation yet into how companies are using this accounting technique to dramatically exaggerate their emissions reductions, Bloomberg Green analyzed almost 6,000 climate reports filed by corporations last year. The reports were submitted voluntarily to CDP, a nonprofit that runs a global environmental disclosure system. At least 1,318 companies employed market-based accounting to erase a combined 112 million metric tons of emissions from their records. That’s equivalent to the annual pollution from 24 million cars.

Read the full methodology here.

Some of the climate gains are real. But many of these supercharged emission-reduction claims fail to benefit the atmosphere. That’s because hundreds of companies, including Procter & Gamble, Cisco, and Continental, rely heavily on certificates, known as renewable energy credits (RECs) or guarantees of origin (GOs), to achieve their climate goals. RECs and GOs have long been targeted by critics who contend they do very little to lower emissions. (P&G, Cisco, and Continental all defend their environmental performance and say their carbon accounting follows widely accepted standards.)

“Market-based accounting just ruins the accuracy of greenhouse gas disclosures,” says Matthew Brander, a senior lecturer on carbon accounting at the University of Edinburgh. “If we’re trying to deal with the climate crisis … we need accurate information on when companies have actually reduced emissions.”

The debate about how companies should account for the emissions caused by the electricity they consume is no trivial matter. One-quarter of the planet’s heat-trapping emissions are caused by the production of electricity and heat. Commercial and industrial customers gobble up about two-thirds of that energy.

Businesses typically purchase their power from local electric grids, which are supplied by a mix of sources—everything from zero-emission wind turbines to sky-choking coal plants. Once power plants feed electricity into the grid, it becomes intermingled like water in a mountain lake fed by different streams. It’s impossible to know which plant supplied the power running a company’s assembly lines, so they’ve traditionally calculated their emissions using the average pollution of the local grid’s energy mix. This is known as “location-based accounting.”

Companies can make meaningful cuts to their pollution with this approach, but progress can be slow and expensive. For instance, Lowe’s Cos., which operates 2,200 home improvement stores in North America, spent $68 million in 2020 to upgrade lighting and air-conditioning equipment at hundreds of stores. The new energy-sipping equipment helped trim its electricity use by 11%. The result: a very real 9% drop in emissions.

Many companies are reluctant to spend this kind of capital, even if it eventually saves money through lower energy bills; those that do find it hard to replicate these kinds of improvements year after year. Others are tantalized by the prospect of marketing dramatic climate improvements to their customers or even declaring their businesses to be carbon neutral.

That’s where the grandiose claims enabled by market-based accounting can make the difference.

When wind or solar farms sell their power to the grid, they get paid for the electricity like any other power plant. The owners of clean energy resources also usually get tax credits from governments. To increase the incentives, corporations began paying the renewable plants an extra bonus for the right to take credit for that clean energy.

This approach relies on a measure of fiction. The corporate buyers never physically use the clean electricity, yet they can claim credit for zero-emission energy on their ledgers.

Many companies became enamored with this method as they discovered it could seemingly wipe away vast quantities of emissions in a hurry. But market-based accounting sparked a bitter debate. The US Environmental Protection Agency and nonprofits such as CDP embraced it as a way to funnel more money into clean energy, believing these extra payments from companies would accelerate the transition away from fossil fuels. On the other side, dozens of academics cringed at the idea of allowing companies to take credit for green energy they hadn’t actually used, fearing it would warp the accuracy of emissions reports and provide a cheap cop-out instead of meaningful greenhouse gas cuts.

In 2015, after years of deliberations, one of the most esteemed climate nonprofits essentially settled the debate. World Resources Institute helps run the Greenhouse Gas Protocol, the most popular emissions accounting standard, which is used by thousands of companies around the world. The Washington-based group said companies should include both location- and market-based numbers in their emissions filings, but they could pick either method to underpin their public climate claims. Companies flocked to the more creative approach.

“Once it had the GHG Protocol’s blessing, then all hell broke loose,” says Michael Gillenwater, executive director of the Greenhouse Gas Management Institute, a nonprofit that provides carbon-accounting training to climate professionals. “Now whenever I talk to companies, they say, ‘Well, the EPA and the GHG Protocol say it’s fine, so we don’t need to think about it. It’s been blessed.’ ”

WRI and its partners are now reevaluating the decision and have started a review of the standard with a particular focus on how electricity emissions are measured. But any changes aren’t expected for at least two years. “These critiques are well heard and appreciated,” says Michael Macrae, a senior manager at WRI.

To be sure, some of the ensuing clean energy contracts have had major climate benefits. Last year, for instance, more than 100 companies including Amazon.com, Nestlé, and Target signed long-term power purchase agreements (PPAs) for wind or solar power. In these complex transactions, companies claim credit for green power that they don’t consume. But the companies will typically shoulder some of the power plant’s risk for a period of 10 or 15 years, which helps the renewable developer get financing to build the project.

These arrangements often result in new clean energy projects that are “additional”—meaning they wouldn’t exist without the corporate partner’s help. “PPAs really helped spur the proliferation of renewable energy projects,” says Fahad Afolabi, director of capital markets at Brookfield Renewable, which builds and owns clean energy plants.

RECs and GOs, on the other hand, do little to get new clean energy plants built. Unlike power purchase agreements, these are typically short-term transactions that allow a company to acquire credits from facilities that have already been operating for years, with the corporate buyer shouldering none of the power plant’s risks.

“I’d argue they don’t stimulate investment at all,” says Gerard Pieters, who ran renewable financing at German bank Nord/LB and is now a director at Tierra Underwriting, which insures clean energy transactions. “From a banking perspective, after 15 years of looking at models and investments, they’ve just never carried any value.”

Academics have reached similar conclusions. Gillenwater studied wind power investments in the US in 2013 and found RECs were an inconsequential source of income. A 2019 paper from Corvinus University of Budapest, meanwhile, found GOs were too inexpensive in Europe to spur development of new renewable plants.

Even a corporate stalwart such as Walmart Inc. figured out this glaring weakness in market-based accounting almost a decade ago. In a 2014 paper explaining its aversion to using RECs to hit its renewable energy targets, the retail giant said it feared these credits were “simply shifting around ownership of existing renewable electrons” without “the desired impact of accelerating renewable energy development.”

That hasn’t kept RECs and GOs from attaining huge popularity among corporate buyers, according to Bloomberg Green’s analysis of the CDP data.

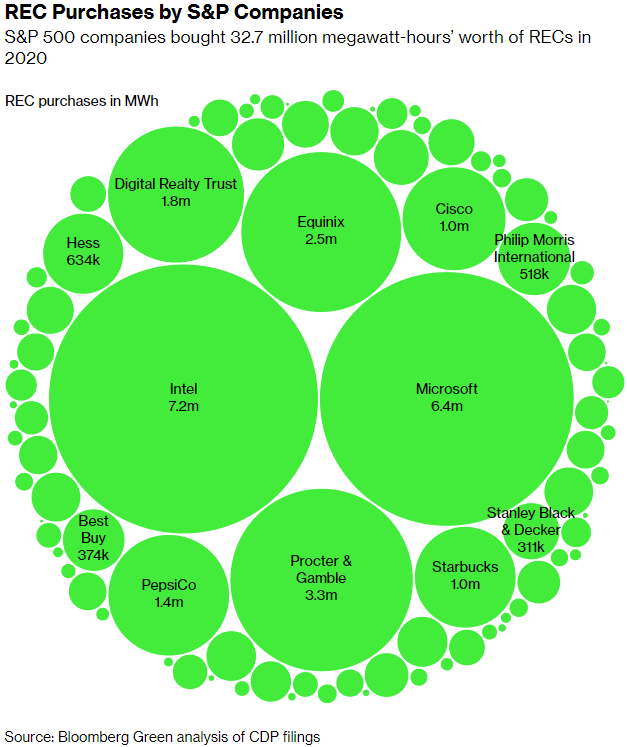

Many of the 1,318 companies that used market-based accounting in their 2021 filings didn’t specify the types of renewable energy contracts they use to reduce their electricity footprint, known as “scope 2” emissions in climate-accounting jargon. But of those that do, nearly half purchased RECs or GOs representing 108 million megawatt-hours of electricity. That’s equivalent to half the annual power consumption of Spain—poof!—erased from these companies’ ledgers.

This is leading to wildly inflated claims of climate progress. Researchers at Concordia University in Montreal published a study this year examining 115 companies that set climate goals pegged to the Paris Agreement’s aims of limiting global warming to 1.5C or 2C. The companies reported combined reductions of 31% from 2015 to 2019. Without RECs, however, their emissions fell only 10%— leaving many well behind the Paris Agreement’s trajectory. “The widespread use of RECs raises doubts on companies’ apparent historic Paris-aligned emission reductions,” wrote the authors, “as it allows companies to report emission reductions that are not real.”

“At a very fundamental level, they’re claiming to have reduced emissions when they haven’t”

The seductiveness of these credits is illustrated by Cisco’s environmental claims. Five years ago, the tech giant vowed to slash 60% of its operations-related emissions by 2022 from 2007 levels. It beat that impressive target last year, reporting a 61% drop in pollution. RECs, however, have long supplied most of the company’s improvements. Rerunning the numbers under location-based accounting, Cisco’s emissions moved in the other direction—climbing 22%.

It’s been incredibly inexpensive for Cisco to transform its appearance from a climate laggard to a green champion. The company reported spending $600,000 on RECs in 2020, or about 60¢ per credit. For just 1/18,000th of its $11.2 billion in profit that year—or the income it made in 28 minutes—Cisco bought enough credits to completely flip its environmental image.

Mary de Wysocki, Cisco’s chief sustainability officer, says RECs have become more expensive since 2020 and they send a signal to the market that more low-carbon energy is needed. The company is working hard to sign more long-term contracts, she says, “that are really adding renewable energy.” In 2015, for instance, Cisco signed a 20-year power purchase agreement with a solar plant in the Sonoran Desert, which accounts for about 4% of the company’s renewable energy. “You’re going to see us continuing to move in that direction,” she says.

This refrain is echoed by many other major REC buyers. JPMorgan Chase & Co., Wells Fargo & Co., and others similarly say they’re transitioning away from RECs to long-term agreements.

But the pace of progress can be slothlike. When Wells Fargo announced in 2017 that it was powered exclusively by renewable energy, the bank also vowed to transition in three years from buying RECs to long-term contracts “that fund new sources of green power.” As of 2020, just 0.5% of Wells Fargo’s clean energy came from on-site solar panels or long-term power purchase agreements. “We’re trying to align the renewable projects with where we have the electricity demand, so it takes a bit more work,” says Richard Henderson, head of corporate properties. Bank officials add that these numbers will soon improve, as they’ve signed several long-term deals with plants that will begin operating in a few years.

Others, including PepsiCo Inc. and Dell Technologies Inc., quit using RECs in the past only to relapse. Pepsi was one of the planet’s biggest buyers of renewable credits in the late 2000s, but executives worried it wasn’t doing much to help the climate. There was significant concern that these credits weren’t getting new renewable projects built, says David Walker, who was an environmental manager at Pepsi at the time, before retiring in 2015. “Did you buy an indulgence? Did you have your sins forgiven for a large donation? Or did you make a difference?”

The beverage giant announced in 2010 that it would move away from buying these credits, because it felt it could have more impact developing clean energy projects on its own buildings. The restraint lasted until two years ago, when Pepsi reentered the market with gusto, purchasing 1.4 million credits—or the 15th biggest amount, according to the CDP data. That allowed Pepsi to claim it had slashed climate-warming pollution from its operations by almost a quarter since 2015.

In a statement to Bloomberg Green, Pepsi officials said they’re transitioning to power purchase agreements “that put new renewable electricity on the grid,” having signed six such deals since 2020. When these projects are all operational in two years, the company expects they’ll account for 70% of its electricity use in the US.

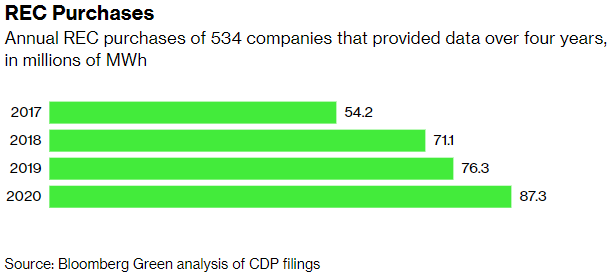

But while many companies say they’re moving away from RECs and GOs, the CDP data indicate these instruments are only getting more popular. When looking at the last four years of disclosures, 534 companies supplied detailed information about their renewable energy contracts every year, including some that haven’t purchased RECs. As a group, these companies in 2021 reported buying a combined 87.3 million MWh worth of credits, which is 61% more than the 54.2 million reported in 2018.

Some of the world’s biggest buyers of the credits, meanwhile, have no immediate plans to change course.

Intel Corp., for instance, has leveraged RECs to refashion itself into a beacon of environmental virtue, recently ranked No. 1 on Barron’s 100 Most Sustainable Companies list. In reality, the tech titan’s contribution to climate damage is growing rapidly. With dozens of offices and energy-hungry chip plants, Intel’s electricity use soared 48% from 2017 to 2020, as it manufactures increasingly complex products. That’s double the company’s 24% increase in sales.

This is bad news for the climate. But the extent of Intel’s difficulties is hard to decipher from its environmental reports. That’s because the company acquired 7.2 million RECs—the most of any company in Bloomberg Green’s analysis—to claim 82% of its power in 2020 came from renewable sources. So instead of reporting a 38% jump in emissions from 2017 to 2020, it reported a more modest 17% increase.

More glaring, the company claims that since 2000, it’s cut emissions by 19%. In reality, when excluding RECs from that calculation, Intel’s climate footprint has jumped by more than a third.

Marty Sedler, Intel’s director of global utilities and infrastructure, pushes back on the notion that RECs are an empty gesture or hugely inferior to long-term power purchase agreements. By delivering added income to a renewable power plant, Sedler says, RECs are generating more demand. “Anything you do that is positive and adding contributions to the renewable industry is a good thing,” he says. “If I go to a charity and give $10 or a million dollars, my $10 is not bad. Maybe it’s not as good as a million. But it’s still the right thing to do.”

Making a dubious claim of major climate progress, however, isn’t exactly harmless. “At a very fundamental level, they’re claiming to have reduced emissions when they haven’t,” says Brander of the University of Edinburgh, referring to the company. “That seems massively problematic.”

Claire Lund, vice president for sustainability at GSK Plc, has seen how this accounting system can put climate-friendlier projects at a disadvantage. When the UK drugmaker set out in 2020 to eliminate all its emissions within a decade, it began buying up hundreds of thousands of RECs and GOs, which created the impression that it had immediately cut its electricity emissions in half.

At the same time, the company was working with a renewable developer to add two giant wind turbines and 45,000 solar panels to its manufacturing facility in Scotland. GSK won’t own the clean energy project when it begins operating next year. Instead, it’s signed a 20-year power purchase agreement that enabled the plant to be financed and built, according to Jens Rosebrock, managing partner at Farm Energy, which owns the facility.

The Scotland project has a very real climate impact. Yet Lund says it “weirdly” counts the same as buying RECs and GOs. “Our market-based emissions will not differ. This is my challenge,” she says.

This is the crux of the problem for Gillenwater of the Greenhouse Gas Management Institute. If companies get equal credit for vapid clean energy contracts that have little impact on the climate, what incentive do they have to take more meaningful action? “We should all want a system that accurately reflects what’s happening to the atmosphere,” he says, “not just something that’s convenient for companies’ PR efforts.”

Read the full methodology here.

Comments